Grow your business with FlexPay

Empower your customers with flexible payment options at checkout

The next stage in the evolution of flexible payments

FlexPay gives your customers versatile payment options. They can opt to pay in instalments over 3 to 48 months with rates as low as 0%. They can also choose our Flexible Credit option to purchase with credit at standard APR and decide how much they want to repay each month.

Boost sales

Increase your sales by giving your customers the flexibility to choose how and when they pay.

Convert new customers

Win more new customers with our dual-lender proposition and by tapping into our customer base who can use their FlexPay account at any business within the FlexPay network.

Improve customer loyalty

Attract repeat spend with customers given a revolving line of credit to use with your business.

Two lenders. More customers.

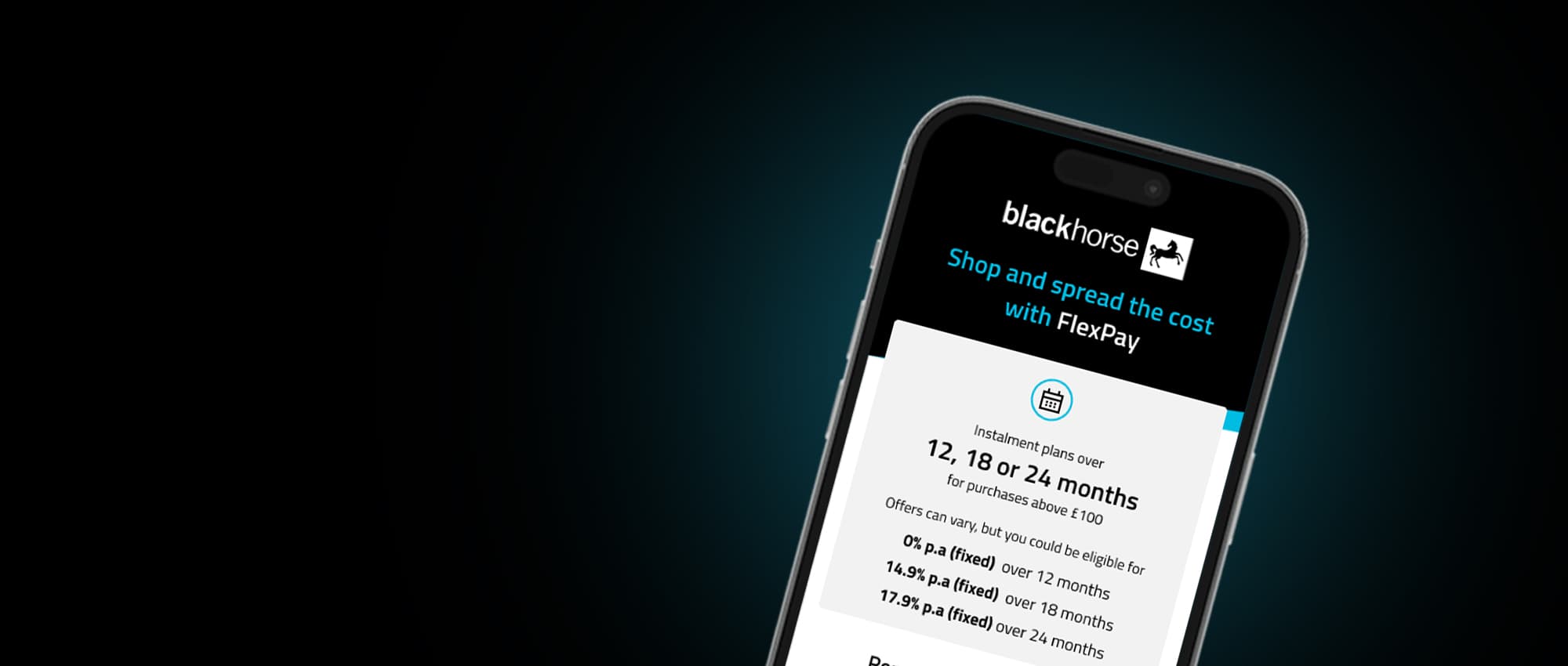

FlexPay enables more of your customers to access credit and spread the cost of their purchases.

Customers initially apply for FlexPay, but if not approved, they can choose to check their eligibility with a secondary lender, NewDay, without the need to complete a second application. It couldn’t be simpler.

Flexible payment options

After completing a one-time application, we offer two payment options to let eligible customers flex the way they pay. And there is just one monthly repayment for all purchases.

Pay in instalments

Customers can spread the cost of their purchases between £100-£5000 over 3-48 months, with rates as low as 0%.

Pay with flexible credit

Customers can use their credit to make a purchase and choose how much to pay back each month. Flexible credit is charged at standard account APR, and the customer must pay at least the contractual minimum payment each month.

FlexPay delivers real value to our merchants

We’re helping to fuel long term business growth with a range of benefits.

- Attract new customers

- Reduce cart abandonment

- Drive bigger basket sizes

- Boost repeat spend

- Convert more shoppers

- Next day settlement

Meet the demand for financial flexibility

33%

Expected growth for embedded finance industry

* Finder

£44.8bn

Forecasted Buy Now, Pay Later market value by 2028*

* Global Newswire

78%

Nearly 4 in 5 people want to spread the cost of bigger purchases*

* Basket spends over £1000, research commissioned by NewDay with 2,000 UK adults weighted to be nationally representative, 27th January 2023 – 31st January 2023

Flexible integration options

We offer several options to easily integrate FlexPay into your e-commerce platform. These include a direct option to integrate FlexPay APIs with simple JavaScript or via pre-approved turnkey plugins for the WooCommerce and Magento platforms.

Why FlexPay

Growth

We work as a strategic partner to help you drive business growth by attracting, converting and retaining more customers.

Trusted

A fully regulated product delivered by a trusted brand with a rich history of delivering innovative solutions.

Flexible

Whether it is choosing integration options or configuring your own promotional rates, we empower you to make the choices that best suit your business needs.

Part of Lloyds Banking Group

Lloyds Banking Group has an impressive heritage, comprising of brands like Lloyds Bank, Halifax, Bank of Scotland and Scottish Widows.